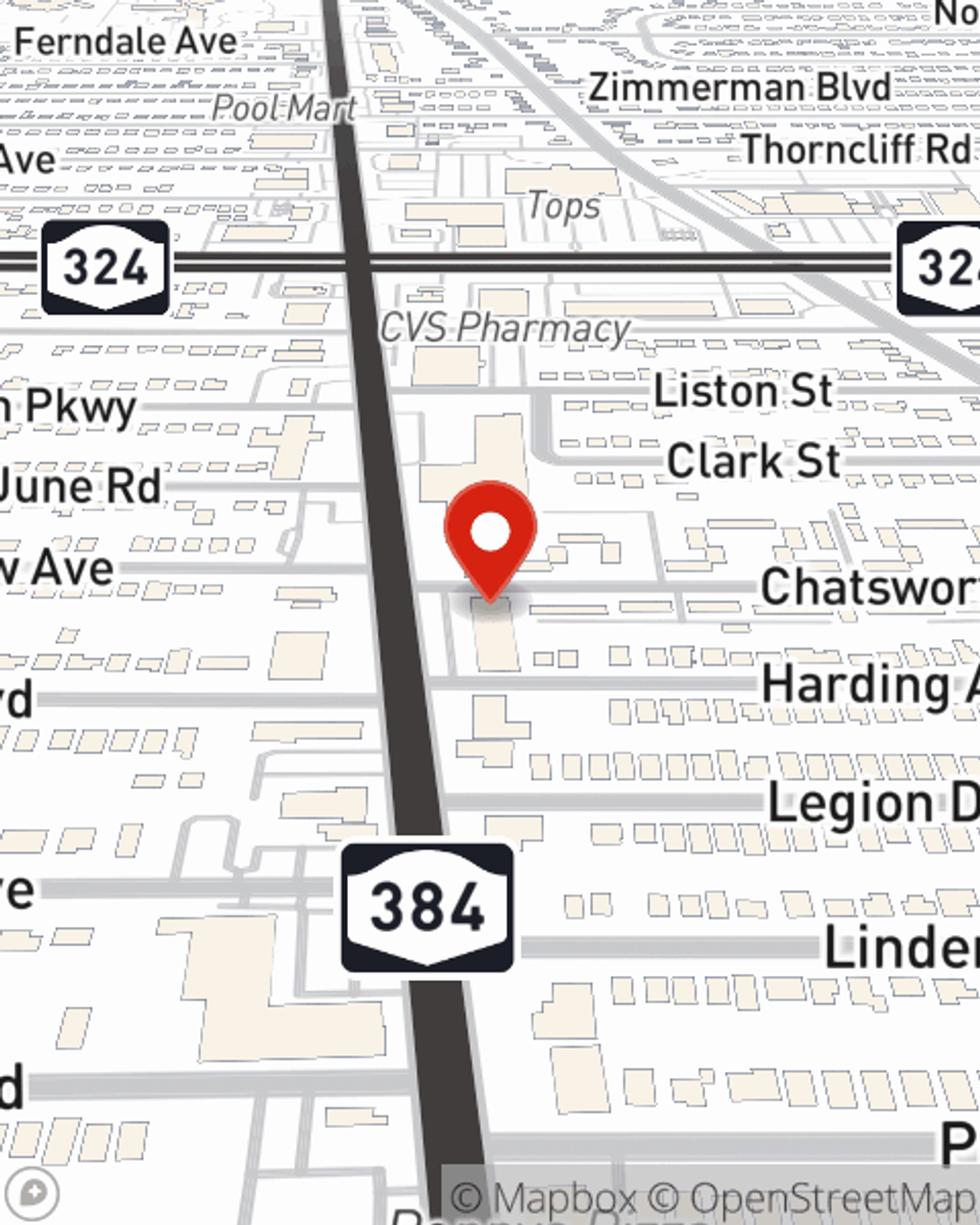

Condo Insurance in and around Kenmore

Looking for excellent condo unitowners insurance in Kenmore?

Condo insurance that helps you check all the boxes

Would you like to create a personalized condo quote?

There’s No Place Like Home

There is much to consider, like savings options providers, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a hard decision. Not only is the coverage impressive, but it is also well priced. And that's not all! The coverage can help provide protection for your unit and also your personal property inside, including things like souvenirs, bedroom sets and linens.

Looking for excellent condo unitowners insurance in Kenmore?

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from theft, water damage or fire.

Intrigued? Agent Kathleen Clouden can help outline your options so you can choose the right level of coverage. Simply reach out today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Kathleen at (716) 873-6015 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Kathleen Clouden

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.